Attrition in the financial services industry is a problem.

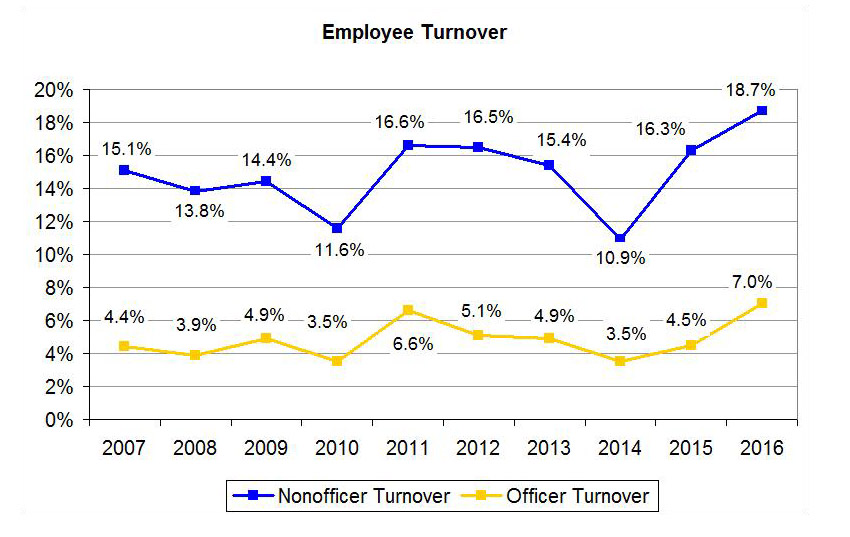

According to the Crowe Horwath LLP Financial Institutions Compensation and Benefits Survey employees are changing jobs at a faster pace, with turnover rates in American banking for officers and non-officers alike reaching a decade high in 2016.

Alarmingly, only two years prior, in 2014, they were at a ten-year low!

Since then, both rates have practically doubled and have passed pre-2008 recession levels (see Exhibit 1 below).

Source: 2013-2016 Crowe Horwath LLP Financial Institutions Compensation and Benefits Surveys

While many factors play a role in this large turnover rate, looking deeper into the data isolates one glaring disruptor – millennials.

In a PwC survey of millennials working in the financial services sector, it was found that only 10% plan to stay in their current role for the long term.

In addition, 42% of respondents said they would be open to new opportunities and 48% were actively looking for new opportunities.

Couple this with the fact that 40% of employee turnover happens within the first six months of hiring, as well as the average employee holding a position for only 17 months before jumping ship, and you’re faced with a serious employee retention problem.

Attrition in the financial services industry is an urgent challenge.

The financial services industry as a whole needs to recognize the true costs of turnover, understand the underlying causes, and develop strategies to address these causes in order to combat this ever-growing problem.

Changing work environment

Our work environment has changed. In stable times, companies grew larger to leverage economies of scale and increase improvement.

An implicit deal was offered to workers: “We provide lifelong employment in exchange for loyal service.”

However, as Heraclitus of Ephesus, a pre-Socratic Greek philosopher is most famously quoted for saying, “No man ever steps in the same river twice.”

The only thing that is constant is change.

The world changed, both philosophically and technologically, and employment structures have been struggling to keep up.

The old model of employment was a good fit for an era of stability yet the Information Age ushered in a communications revolution and the globalization of business, creating rapid and unpredictable change.

The rise of shareholder capitalism led companies and managers to focus on attaining short-term financial targets over long-term investment goals in order to boost stock prices.

As a consequence, adaptability and entrepreneurship became key to achieving and sustaining success in business.

The outcome

Today, few companies are able to offer guaranteed employment yet still ask employees to commit to the organization without committing to them in return.

Many employees have responded by keeping their options open, constantly scanning the marketplace for new opportunities, regardless of how much they profess their loyalty during the recruiting process or annual reviews.

Both parties act in ways that blatantly contradict their official positions.

Consequently, a fundamental disconnect and level of distrust is formed in the employer-employee relationship of today.

Strengthening the relationship between companies and employees

Co-founder and chairman of LinkedIn, Reid Hoffman, and entrepreneurs Ben Casnocha and Chris Yeh, explore different ways to create a mutually beneficial relationship and strengthen the connection between companies and employees in their book, “The Alliance: Managing Talent in the Networked Age.”

They state that employers, managers, and employees need a new relationship framework where they make promises to one another that they can actually keep.

Top leadership training company and global innovator, Interaction Associates’ multi-year “Building Trust” research has demonstrated that trust is the foundation for strong leadership that drives impressive business results.

A staggering 82% of respondents say trusting their boss is essential to effectiveness in their jobs, yet the company’s 2014/15 report shows that trust in the business world is near an all-time low.

Poor Reputation

When it comes to trust, the financial services industry is still suffering the consequences of the global financial crisis of 2008.

The collapse of some of the biggest financial institutions in the world has given the industry a poor reputation.

This bodes poorly for the financial sector as the increasing influx of a millennial workforce is seeking out industries and organizations that have a cleaner reputation.

This is due to the fact that millennials value the image and reputation of the companies that they work for significantly more than their Gen X and baby boomer predecessors did.

Exemplifying this, PwC found that 21% of millennials currently working in the financial services industry would rather not work in the industry due to the perceived negative reputation.

The cost

Many different options are available to the workforce of today when it comes to their careers. This includes changing companies, functions, regions and so forth.

In fact, a survey conducted by LinkedIn found that one in three people who changed jobs, changed careers entirely.

Should the previously mentioned 21% of millennials that would rather no longer work in finance decide to change their careers completely, the costs associated with employee turnover could be devastating to the entire industry.

According to Dr Britt Andreatta’s LinkedIn Learning Course: Organizational Learning and Development, the cost of attrition to an organization is as high as 250% of a top performer’s annual salary.

The cost of disengagement is equally alarming.

Gallup, the leading authority on employee engagement, estimates 17.2% of the U.S. workforce is actively disengaged.

This means employees are unhappy and acting out that unhappiness at work in the form of tardiness, missed work days, and decreased productivity.

It is estimated that a disengaged employee costs an organization approximately $3 400 for every $10 000 of salary, that’s 34 percent!

The need for engagement

Engaged employees make it a point to show up to work and do more work. They are interested and committed, both to their work and to their organization.

The modern workforce considers an engaging work environment to be a fundamental expectation and many employees refuse to settle for an organization that does not strategically prioritize engagement.

According to Gallup, only 29% of millennials are engaged at work.

This low level of engagement means that millennial employees are less likely to feel connected to their job and, therefore, more likely to change jobs.

Attrition in the financial services industry is an urgent challenge. A culture of engagement is no longer an option – it is an urgent need!

Fostering a culture of engagement

By making corporate culture a priority, organizations are able to deliberately create and leverage a culture of engagement, positively affecting morale, company performance, employee retention and profitability.

Prioritizing engagement is a competitive, strategic point of differentiation that organizations in the financial services industry can use to make themselves more desirable to employees.

Highly engaged organizations know that engagement starts at the top. Managers engage employees from the minute they show up on their first day and communication remains open and consistent.

These organizations have well-defined and comprehensive development programs for leaders and managers, and they focus on the development of individuals and teams.

Employee retention solutions from vi

vi by Aderant’s Employee Retention solution is designed to help organizations manage the employee integration process efficiently and consistently.

Our program helps you develop your employees by providing actionable retention steps such as welcome calls, mentor meetings, diversity and inclusion opportunities and activities etc. along the way.

Measure year-over-year attrition rates, track diversity trends and ensure employee retention initiatives are working by getting started now.

There’s a path to retention – start mapping yours today with vi.